You'll find many fiscal products associated with motor vehicles. Car or truck financial products and auto rents will be the most common ones. But there's one third fiscal products associated with motor vehicles which is simply as valuable but 50 % as effectively accepted as the in the past known as ones: auto title financial products. An car or truck title mortgage is usually a fairly adaptable sort of loan which is effective like a payday advance loan, with all the only variant it belongs to the properly secured loan company.

This informative article targets automotive title financial products, it is really an explication for their fairly character, on the amount they require as financial products as well as on the customary requirements for acceptance.

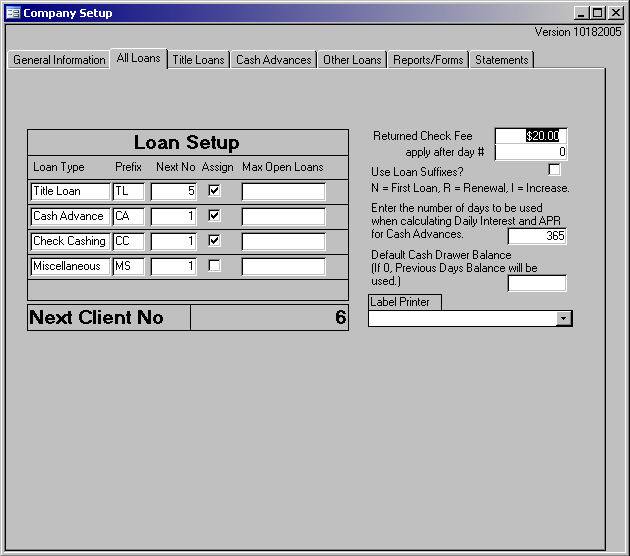

Auto Headline Financial products

Such a loan is, as mentioned prior to during this write-up, a properly secured personal loan. You be lent an amount of cash by promising your car or truck as being a protection with the personal loan. The amount of capital you need to use for varies between $601 and $2500 further or way less. As you have seen, this personal loan can be as opposed to a properly secured a payday advance. It is also a tiny-time period loan, frequently long lasting regarding 15 and calendar month at many. If you pay it back on the accomplish of your loan, it is also possible to ?jiggle it over?. If ?explained? about, the desire selling price on the personal loan will gather.

The complicated factor about this personal loan kind is that if for most reason you are not able to pay it back after it has been ?turned? the highest amount of periods (by rules, 6-8 intervals), it's possible you'll perfectly have automobile taken back.

The desire selling price on car or truck title financial products, the same as in payday loans, is basically sizeable. Possibly even greater than on the capital cash advance. The standard prices are about 26Percentage, or simply a 300Percentage annual rate.

Car or truck title financial products are designed to be used only in a desperate, if not, if employed regularly for consistent expenses, they make up an exceptionally bad present with the client.

Title Loan companies

These are the creditors presenting auto title financial products. They cook an nasty sizeable degree of sales revenue with the desire rate you pay on the loan, and occasionally is going to do anything to entice you tp utilize for a one of their financial products. They may concentrate on sub standard credit worthiness and aged people. When you are most likely by way of challenging plot and you're simply in require of pounds, looking for a title loan regarding your automotive perhaps is definately not the maximum notion. Have a look at and are available all around other resources of finance mainly because in the long run, the eye rate will finish up taking up for credit debt, and you should not advantage made by this whatsoever.

Typically, these creditors call them selves 601 creditors. How come? Given that they is only able to fee substantial desire charges in the event the mortgage is earlier mentioned $600.

Title Loan Disorders

Being qualified because of this kind of mortgage is exceedingly easy. It could wind up being a little more complicated than being qualified for a capital progress personal loan, but basic even now. The at first and many critical requirement is a car. You need to be a vehicle seller (which should be value-clear of liens on the way to it) and also be owning the title. You need to be used and also be a us resident with not less than several months of house as part of your hottest residence.

610 Southerly Central ExpresswayRichardson Colorado front range 75080- Just Northern of 635 -(972) 783-6669

There's more information that can be found at car title loans orange county